Processing Services

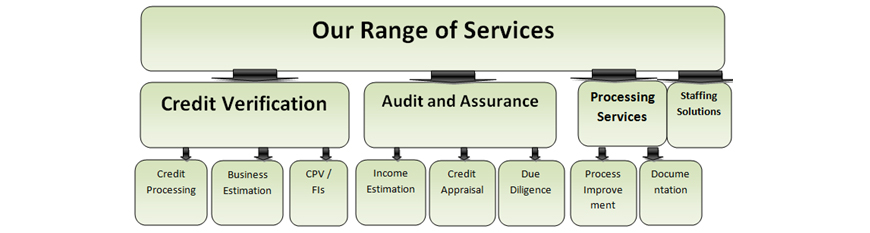

Considered one of the premier companies which handles Credit Verification, Credit Appraisals and Process Outsourcing in India, Veeraraghavan & Co. is working towards handing end-to-end processing for almost areas in the Financial Services Outsourcing domain.

The committed team has ensured that they provide quality services across a number of disciplines. At Veeraraghavan & Co. the motto is "Customer Satisfaction". That is why we customize our products and services to meet client needs.

Clients are free to structure their own requirements and provide us a RFP. We have direct contacts as well as an ability to raise a request on our contact page

The committed team has ensured that they provide quality services across a number of disciplines. At Veeraraghavan & Co. the motto is "Customer Satisfaction". That is why we customize our products and services to meet client needs.

Clients are free to structure their own requirements and provide us a RFP. We have direct contacts as well as an ability to raise a request on our contact page

Documentation and Processing Services

Veeraraghavan & Co. provides in-depth processing services which include managing back offices, handling basic and complex process improvements, managing high manpower turnover businesses, handing documentation creating, filing and delivery, managing high volume data entry and quality control, managing documentation checks and retrieval, cheque processing etc.

All Veeraraghavan & Co. solutions are customized to meet with client needs and are dependent on customer focus. We ensure that your needs are met and you are confident to outsource business with us. With our long history with top clients, we have made a name for ourselves as trustworthy, experienced, quick and quality conscious partners. We endeavor to achieve your efficiency and quality goals.

All Veeraraghavan & Co. solutions are customized to meet with client needs and are dependent on customer focus. We ensure that your needs are met and you are confident to outsource business with us. With our long history with top clients, we have made a name for ourselves as trustworthy, experienced, quick and quality conscious partners. We endeavor to achieve your efficiency and quality goals.

Account servicing processes

For credit cards or consumer loans. Veeraraghavan & Co. is looking to enter this area. The services include payment processing systems and services, customer service support operations (digital, email and mail services), product renewals, and loan disbursement; document management services such as printing and mailing of statements, storage solutions, recoveries processing, risk and default management and foreclosure documentation.

Consumer and commercial lending post origination transaction processing services

Such as check processing, clearance and settlement services, remittance, and records management.

Back office transaction process management for loans or credit card portfolios

including fraud mitigation and detection, regulatory and program compliance, portfolio analytics & reporting.

Copyrights 2012 Veeraraghvan Designed by Fiveonline.in